"Unlock the secrets of successful investing with our expertise"

gaurav goyal

Hello, I’m Gaurav Goyal, bringing over 11 years of extensive experience in the share market. My journey has been enriched by reading more than 200 books and earning an NISM certificate, which has deepened my understanding of market trends and trading strategies. Having participated in over 200 webinars and 100 seminars, I’ve gained valuable insights into the psychological aspects of trading and how to avoid common pitfalls. I’m eager to share my knowledge and contribute to a collaborative learning environment in this course, helping others achieve their financial goals.

The Best Coaching in the Share Market: Gaurav Goyal

In the dynamic world of share trading, having the right guidance can significantly impact one’s success. This is where Gaurav Goyal stands out as a premier coach in the share market arena. With over 11 years of extensive experience, Gaurav has honed his expertise through a combination of theoretical knowledge and practical application, making him an invaluable resource for aspiring traders and seasoned investors alike.

Gaurav’s journey in the share market began with a deep-seated passion for trading and finance. Over the years, he has immersed himself in learning, having read more than 200 books on the subject, each contributing to a comprehensive understanding of market mechanics. Additionally, he holds an NISM certificate, further validating his commitment to professional development and mastery of share market principles. This robust foundation allows him to demystify complex concepts and present them in an easily digestible format, ensuring that his students grasp essential trading strategies and market trends.

One of the key elements that sets Gaurav apart is his extensive participation in over 200 webinars and 100 seminars related to the share market. These experiences have not only broadened his knowledge but also provided him with unique insights into various trading techniques and psychological aspects that influence trader behavior. Gaurav recognizes that successful trading is not just about numbers; it’s about understanding market sentiment and the emotional challenges traders face. His coaching incorporates these critical elements, equipping students with the tools they need to navigate both the technical and emotional landscapes of trading.

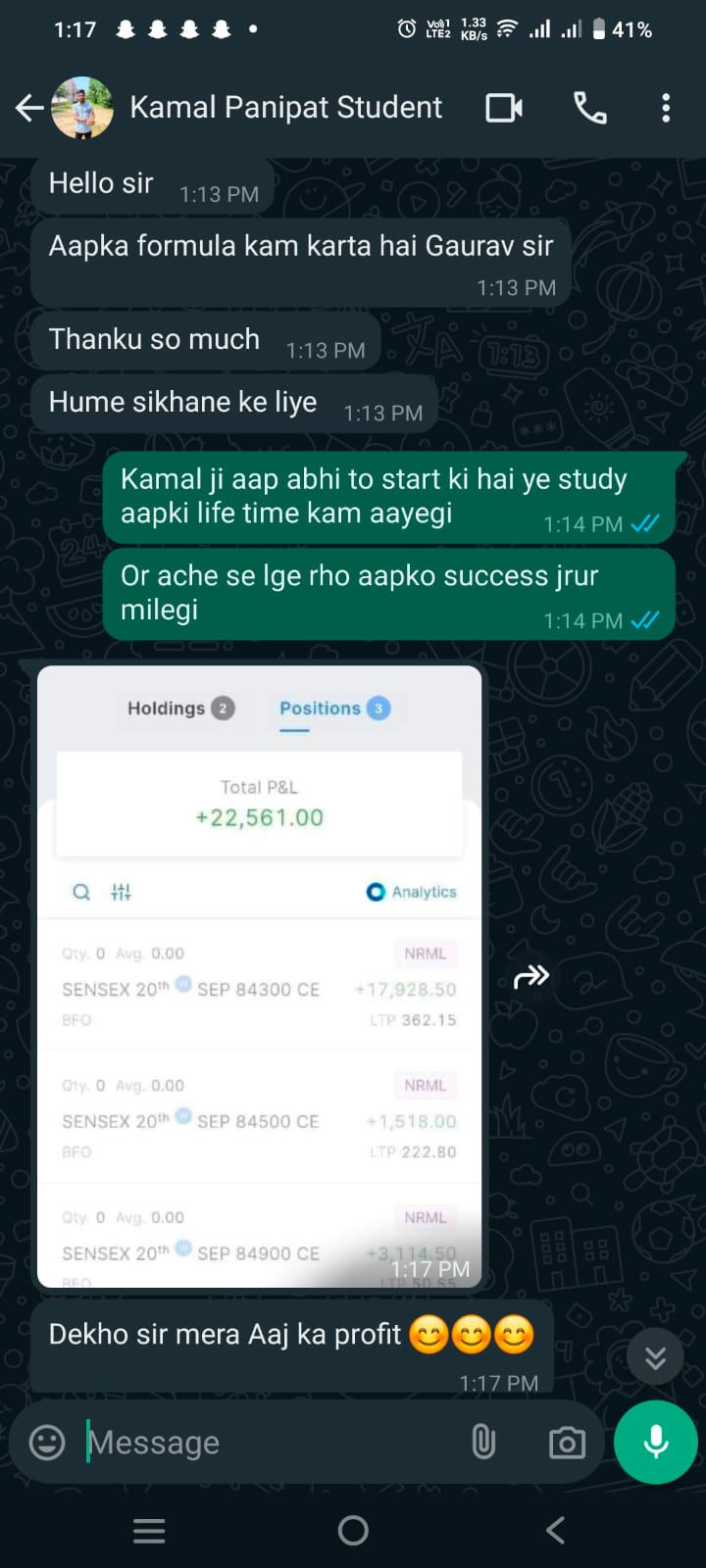

Gaurav’s coaching philosophy revolves around fostering a collaborative learning environment. He believes that sharing insights and experiences among peers enhances the learning process. By creating a community where students can discuss strategies, share successes, and learn from setbacks, Gaurav cultivates an atmosphere of mutual support and encouragement. This approach not only helps students avoid common pitfalls but also empowers them to develop their own trading styles and strategies tailored to their individual risk tolerances and financial goals.

Moreover, Gaurav is keenly aware of the importance of practical application in learning. His coaching sessions are designed to be interactive and hands-on, allowing participants to apply theoretical knowledge in real-time scenarios. This practical approach ensures that students can confidently implement what they’ve learned, whether it’s developing a trading plan, analyzing market trends, or managing risk effectively. Gaurav’s commitment to practical learning prepares students to face the challenges of the market head-on, significantly increasing their chances of achieving financial success.

In conclusion, Gaurav Goyal embodies the essence of effective coaching in the share market. With his extensive experience, dedication to continuous learning, and a keen understanding of both market dynamics and trader psychology, he provides invaluable guidance to his students. His focus on creating a collaborative and interactive learning environment ensures that aspiring traders are not only equipped with knowledge but also supported in their journey towards financial independence. For anyone looking to navigate the complexities of the share market successfully, Gaurav’s coaching is undoubtedly a transformative experience that can lead to lasting success.

Stock trading requires a combination of knowledge, skill, and strategy. It’s important for traders to stay informed, continuously learn, and practice disciplined trading to manage risks effectively and pursue their financial goals.

OUR COURSES

Basic Course

In this course, you will learn the basics of the stock market, including an introduction to the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). This course will help you understand how the stock market operates, and it will also explain advanced concepts like futures and options.

👉Share Market Introduction:

- What is the share market?

- Introduction to NSE and BSE

- Importance of stock exchanges

👉Basic Concepts:

- Definition of stocks, shares, and equity

- What is market capitalization?

- Bull market vs. Bear market

👉Investing vs. Trading:

- Difference between long-term investing and short-term trading

- Trading strategies and techniques

👉Technical Analysis:

- Use of charts and indicators

- Understanding support and resistance levels

👉Fundamental Analysis:

- Analysis of financial statements and ratios

- How to evaluate a company’s valuation

👉Futures and Options:

- What are futures?

- What are options (Call & Put)?

- Use of derivatives and risk management

👉Trading Platforms:

- How to use online trading platforms

- Types of orders (Market order, Limit order, etc.)

👉Risk Management:

- Portfolio diversification

- Stop-loss orders and risk assessment

👉Regulatory Framework:

- Role of SEBI and regulations

- Measures for investor protection

👉Market Psychology:

- Impact of fear and greed

- Investor behavior and market trends

By the end of this course, you will gain an understanding of the stock market and develop confidence in trading, which will help you make informed decisions. Understanding the world of futures and options will enable you to diversify your investment portfolio and take advantage of new opportunities.

If you want to learn the basics of the stock market, enroll in this course and start your investment journey today!

Technical Course

In this course, the focus will be on key concepts of technical analysis, including candlestick patterns, chart patterns, stop-loss placement, and exit strategies. This course will help you make better trading decisions, enabling you to effectively take advantage of market movements.

👉Candlestick Basics:

- What is a candlestick?

- Structure of a candlestick (body, wick)

- Identifying bullish and bearish candlestick patterns

👉Popular Candlestick Patterns:

- Doji, Hammer, Shooting Star, and Engulfing patterns

- Impact of these patterns on market trends

👉Chart Patterns:

- How to identify support and resistance levels

- Patterns like Head and Shoulders, Triangles, Flags, and Wedges

👉Stop Loss Placement:

- What is stop-loss and its importance?

- When and where to set a stop-loss

- Using trailing stop-loss

👉Exit Strategies:

- How to book profits

- Understanding the risk-reward ratio

- When to exit a position

👉Trading Psychology:

- Discipline and emotional control

- How to handle market volatility

By the end of this course, you will be able to understand candlestick and chart patterns, improving your trading decisions. With the proper use of stop-loss and exit strategies, you will be successful in managing your risks and maximizing your profits.

If you want to gain expertise in trading through technical analysis, enroll in this course and take your trading skills to new heights!

Advance Technical and Option Strategy Course

In my course, you will learn advanced technical analysis tools, how to use indicators, and option strategies. You will understand how to take positions, build a portfolio, and protect your investments when the market declines.

👉Advanced Technical Indicators:

- Using Moving Averages, RSI, MACD, and Bollinger Bands

- How to interpret indicators and generate trading signals

👉Option Strategies:

- From basic to advanced option strategies (e.g., Straddles, Strangles, Spreads)

- When and why to use specific strategies

👉Position Sizing:

- How to size positions for effective risk management

- Importance of risk-reward ratio and portfolio balance

👉Portfolio Management:

- Principles of diversification

- Understanding long-term vs. short-term strategies

👉Market Downturns:

- Protective strategies during market downturns (e.g., hedging)

- Stop-loss and profit-taking strategies

👉Psychological Aspects:

- How to handle market volatility

- Importance of discipline and emotional control

By the end of this course, you will gain proficiency in trading with advanced indicators and option strategies. You will be able to manage your portfolio effectively and be prepared to navigate market fluctuations successfully.

If you want to develop advanced skills in trading, enroll in this course and take your investment journey to new dimensions!

- Create effective options strategies tailored to your financial goals.

- Understand various approaches for taking positions in the options market.

- Learn how to design a stock market strategy that minimizes risk while maximizing potential profits.

- Explore techniques for leveraging options to achieve unlimited profit potential.

- Master the interpretation of option chain data and its significance in decision-making.

- Analyze key metrics such as open interest, volume, and implied volatility to inform your trades.

- Discover the methods successful traders use to consistently remain profitable.

- Learn risk management techniques that help them navigate market fluctuations.

- Understand how to gauge market direction using alternative methods, eliminating the need for chart analysis.

- Identify indicators and signals that can predict intraday market movements.